Asia Pacific Bioprocessing Facilities

$1,999.00

Featuring key Bioprocessing Facilities from China, Taiwan, Korea, Japan, India, SEA, and Australia! Asia-Pacific Bioprocessing Facilities report covers comprehensive information on parameters such as facility size, capacity, production technologies, types of biologics manufactured and much more. It provides readers a closer look into the facilities of Chugai, Hanmi, Daiichi Sankyo, Biocon (India & SEA), Beigene, Amgen (Singapore), GSK (Singapore) and more.

- Description

- Additional information

Description

- Overview

- Scope

- Benefits

- Key Questions Answered

- Data Methodology

- Table of Contents

- Figures & Tables

- User Access

The APAC Bioprocessing facility report features data analysis of key facilities manufacturing large molecules such as Monoclonal Antibodies, Recombinant Proteins, Cell Therapy, Bi-Specific Antibodies, Vaccines and more. The report covers the following regions: China, South Korea, Japan, Taiwan, India, Singapore, Australia and SEA. It sheds light on the facility design, bioprocessing technologies currently used across the manufacturing value chain (starting from cell-line development until fill & finish), plant capacity, facility type (single-use vs stainless steel) and facility investment.

IMAPAC Pte Ltd performed an analysis of the APAC bioprocessing facilities in the region to highlight the various trends of technologies used in the bioprocessing scene today. The report provides biopharma and CMOs the various types of features present in their competitors facilities to better understand the latter’s rationale behind building their facility in such a way.

The report presents insights from conversations obtained from senior representatives of biopharma companies on the following but not limited to:

- Project capacity & Production

- Biologics products manufactured at the site

- Scale of manufacturing (clinical or commercial)

- Bioprocessing employees in the facility

- Use of single-use vs stainless steels systems

- Bioprocessing tools, technologies & solutions employed

- Outsourcing plan

- Partnership & Collaboration

- Future facility expansion plans

The first of the report presents executive summary of the key findings captured in our study. It offers unique insights in relevance to bioprocessing systems and technologies adoption pattern in the Asian countries. It presents top insights into the growing interest of market players in technologies to suit the needs of their production of large molecules like vaccines, antibody fragments, matrix proteins and biosimilars.

The second section provides a general coverage of the report with further detailed analysis of bioprocessing facilities in each Asia-Pacific country including facility establishment, size, bioreactor used, processing technologies and facility investment. It includes a detailed expert poll & survey analysis of biopharma, big pharma and CMO with facilities in Asia such as their detailed profile, pilot and commercial batches run annually, their current focus in terms of cost saving opportunities and their technologies of interest. The section also provides exclusive insights from each biopharma facility from several countries including Greater China, India, Korea, Japan and South-East Asia.

The option to customize the report is available upon request to meet your data requirements which are not included in the report. The customized report is comparatively cost-effective and dependent on data requirements.

APAC Bioprocessing Facilities report features an extensive study of the APAC bioprocessing facilities operating in the region. The study includes an in-depth survey-based analysis, highlighting the capabilities of biopharma and contract manufacturing services providers engaged in the bioprocessing.

The report provides detailed overview on bioprocessing tools, equipment and technologies used by the biopharma, big pharma and CMOs in the facility with an objective to provide a view of competitive landscape and shed light on competitors clients.

Comprehensive regional analysis of the APAC Bioprocessing facilities covering facility information, plant design & capacity information, highlights of facilities and organizations covered in each region, highlights of facilities by types of products manufactured in Asia and analysis of cost-saving considerations in facilities.

Expert poll & survey analysis of bioprocessing facilities in each APAC geographies covering company overview, product pipeline, facility highlights, production capacity, bioprocessing technologies & equipment and insights into future expansion plans of biopharma and contract manufacturers in Asia.

A detailed overview of the bioprocessing facilities and landscape of companies engaged in this domain, based on several relevant parameters, such as list of bioprocessing organizations, in-house manufacturing capabilities, manufacturing facility establishment year, country, location, types of products manufactured, scale of operations (pre-clinical to commercialization), key features of facilities, bioprocessing services offered by company, plant capacity & batch size, facility size & processing technologies (batch/fed-batch/perfusion/continuous), expression systems (mammalian/microbial), name of technology or service providers, ongoing projects of the company, products in pipeline, upstream and downstream processing capabilities, fermentation scales, facility design, engineering, drug substance and product manufacturing, regulatory approvals & certifications accomplished by the organization, amount of investments made in the facility, partnerships & expansion plans of company.

IMAPAC Pte. Ltd. has released this report with an objective to support key industry stakeholders in co-development and other business-related partnerships, to plan future portfolio focus and to invest in research and technologies to fill the gaps identified. IMAPAC will continue tracking the developments in the industry and the implementation of its recommendations.

Asia Pacific Bioprocessing Facilities Report with 250+ page consists of 163 tables and 105 charts that are easy to comprehend. Read on to know more about the bioprocessing facilities in the Asia Pacific region, along with their future expansion plans. The report studies and analysis of key facilities throughout Asia Pacific. Discover exclusive insights from key bioprocessing facilities covering information such as facility establishment, size, key technologies and company profiles. This report lets you explore opportunities in the Asia-Pacific Bioprocessing space by providing deep-dive understanding of the bioprocessing landscape.

This report will assist you in critical decision making and help you to build informed strategies. The unique and detailed report will support your business plans and allow you to access and understand bioprocessing landscape better.

Through our report, you are more likely to stay ahead of your competitors and expand your knowledge and expertise in bioprocessing facilities. This report may potentially help your research, analyses, and strategic decisions. IMAPAC’s Report is intended for anyone who demands comprehensive and in-depth analyses for key APAC Bioprocessing Facilities.

- How many bioprocessing facilities are operating in Asia?

- Which products are manufactured in each facility in Asia?

- Which type of cell culture is used in each facility?

- What kind of bioreactors are adopted in the bioprocessing capacity?

- What is the scale of upstream manufacturing capacity of each facility?

- What are the current projects of biopharma organizations?

- What is the current focus of organizations in terms of cost saving involved in bioprocessing?

- In which phases of development does each organization currently have biopharmaceutical products?

- How many total batches did each facility run during the past 12 months for commercial production?

- What are the components of plant design and challenges faced in plant designing?

- What is the capacity of each manufacturing plant in litre?

- What are the future plans of Biopharma and CMOs in terms of facility expansion?

The data in this report is researched and validated using primary and secondary research. The data is collected through multiple scientific and non-scientific sources including live discussions with experts through IMAPAC’s events and research reports, company websites, press releases, publicly available information, regulatory database and many more.

- Preface

- Executive Summary

- Bioprocessing Facilities in APAC

- Report Coverage

- Regional Analysis of the Bioprocessing Facilities

- Facility Establishment vs Year of Operation

- Facility Size

- Bioreactor Type

- Expression System

- Process Technologies

- Facility Investment

3.3 Expert Poll & Survey Analysis 1: Biopharma, Big Pharma, CMO with Facilities in Asia

3.3.1 Respondent Profiles

3.3.2 Facility Type

3.3.3 Batches Run in 1 year (Pilot & Commercial)

3.3.4 When it comes to cost savings, what is your focus currently?

3.3.5 Facility expansion plans

3.3.6 Which Technologies are interesting for you?

3.4 Exclusive Insights from the Biopharma Facility

3.4.1 Kemwell Biopharma

3.4.2 Samsung Biologics

3.4.3 Kolon Life Science

3.4.4 Medipost

3.4.5 Binex

3.4.6 Eubiologics

3.4.7 United Biopharma

3.4.8 Celltrion

3.4.9 JHL Biotech Taiwan

3.4.10 AGC Biologics

3.4.11 Chugai Pharmaceuticals

3.4.12 Sumitomo Dainippon

3.4.13 Unicocell

3.5 Bioprocessing Facilities: Greater China

3.5.1 Akeso Pharmaceuticals

3.5.2 Beigene

3.5.3 Chime Biologics

3.5.4 Eirgenix

3.5.5 Innovent Biologics

3.5.6 JHL Biotech

3.5.7 Shanghai Junshi Biosciences Co Ltd

3.5.8 Medigen Vaccine Biologics Corporation

3.5.9 Mycenax

3.5.10 Pfizer

3.5.11 Pharmaessentia

3.5.12 Shanghai Henlius

3.5.13 Sinovac

3.5.14 Tonghua Dongbao

3.5.15 Tot Biopharma

3.5.16 United Biopharma

3.6 Bioprocessing Facilities in India

3.6.1 Aurobindo Pharma

3.6.2 Cpl Biologics

3.6.3 Enzene Biosciences Ltd

3.6.4 Intas Pharma

3.6.5 Kemwell Biopharma

3.6.6 Lupin

3.6.7 Serum Institute of India

3.6.8 Stelis Biopharma

3.6.9 Reliance Life Sciences

3.7 Bioprocessing Facilities in Korea

3.7.1 Aprogen Biologics

3.7.2 Binex

3.7.3 Celltrion

3.7.4 Eubiologics

3.7.5 Gc Pharma

3.7.6 Kolon Life Sciences

3.7.7 Medipost

3.7.8 Polus

3.7.9 Samsung Biologics

3.8 Bioprocessing Facilities in Japan

3.8.1 Astellas (Cell & Gene Therapy Plant)

3.8.2 Chugai Pharmaceuticals

3.8.3 Hitachi

3.8.4 Sumitomo Dainippon

3.9 Bioprocessing Facilities in South-East Asia

3.9.1 Abbvie

3.9.2 Amgen

3.9.3 Glaxosmithkline

3.9.4 Pt Kalbe

3.9.5 Siam Biosciences

3.9.6 Tcels

3.10 Bioprocessing Facilities in Australia

3.10.1 CSL Behring

3.10.2 Csiro

List of Tables

Table 1: Facility sizes of plants covered in APAC

Table 2: Expression systems used by facilities covered in APAC

Table 3: Process Technology used in the facilities

Table 4: Bioprocessing tools and equipment used in the manufacturing value chain

Table 5: Investment made for the facilities covered in APAC

Table 6: Highlights from APAC bioprocessing survey conducted

Table 7: Overview of the facilities featured in Greater China

Table 8: Akeso Pharmaceuticals Antibody Product Pipeline

Table 9: Zhongshan & Guangzhou Bioprocessing facilities overview of Akeso Pharmaceuticals

Table 10: Akeso Pharmaceuticals: Current & Future Bioreactor Capacity

Table 11: Process Technologies in Akeso’s Facilities

Table 12: Development milestones & achievements of Alphamab Oncology from year 2013 to 2020

Table 13: Suzhou Bioprocessing facility overview of Alphamab

Table 14: Alphamab’s Bi-specific Antibody Product Pipeline

Table 15: Current & future capacity of Alphamab Oncology

Table 16: Bioprocessing technologies, tools and equipment for Alphamab Oncology

Table 17: Beigene Immuno-oncology product pipeline (as of Jan 2020)

Table 18: Suzhou & Guangzhou Bioprocessing Facilities Overview of Beigene

Table 19: Summary of Bioprocessing Technologies: Beigene

Table 20: Facility highlights of Chime Biologics manufacturing plant

Table 21: Wuhan Facility Overview: Chime Biologics

Table 22: Different components of facility in Chime Biologics

Table 23: Details of bioprocessing equipment, model of equipment, & solution providers of Chime Biologics manufacturing facility

Table 24: Product pipelines of Eirgenix (as of Jan 2020)

Table 25: Facility Highlights of Hsinchu Biomedical Park, Zhubei: Eirgenix

Table 26: Bioprocessing equipment in Eirgenix’s mammalian cell culture facility

Table 27: Bioprocessing equipment in Eirgenix’s microbial fermentation facility

Table 28: Break-down of the bioprocessing facility in Eirgenix

Table 29: Regulatory approvals of Eirgenix from year 2005 to 2020

Table 30: Future expansion plans from stage 1, 2 and 3 of Eirgenix

Table 31: Product pipeline of Innovent Biologics (as of Jan 2020)

Table 32: Facility highlights of Innovent Biologics

Table 33: Facility overview and highlights of JHL Biotech

Table 34: Design features of JHL Biotech’s manufacturing facility

Table 35: Summary of bioprocessing equipment models and the solution providers associated with JHL Biotech manufacturing facility

Table 36: Facility overview of Junshi Biosciences

Table 37: Product pipelines of Medigen Vaccine Biologics Corporation

Table 38: Facility overview & highlights of Medigen Vaccine Biologics Corporation

Table 39: Highlights of the MVC’s facility

Table 40: Current vaccines manufactured in MVC facility

Table 41: Break-down of MVC facility

Table 42: Facility highlights & overview of Mycenax

Table 43: Product pipelines of Mycenax

Table 44: Product Pipeline: Mycenax

Table 45 Highlights of plant capacity: Mycenax

Table 46: Mycenax Biomanufacturing Plant Highlights

Table 47: Details of current aseptic filling line in Mycenax facility

Table 48: Technology platform in Mycenax’s bio-manufacturing facility

Table 49: Facility overview & highlights of Pfizer

Table 50: Details of different roles and partners in Pfizer’s manufacturing facility

Table 51: Product pipeline of Pharmaessentia

Table 52: Facility overview & highlights of Pharmaessentia

Table 53: Details of Pharmaessentia’s plant design and capacity as per EU/US standards

Table 54: Facility overview and highlight of Shanghai Henlius Biotech

Table 55: Facility overview and highlights of Sinovac

Table 56: Results of quality testing and regulatory approval of Sinovac’s manufacturing facilities

Table 57: Facility overview and highlights of Tonghua Dongbao

Table 58: Product pipeline of Tonghua Dongbao

Table 59: Facility overview & highlights of ToT biopharm

Table 60: Facilities overview and highlights of United Biopharma

Table 61: Overview of 3 plants of United Biopharma

Table 62: Types of bioreactors in Plant in Taiwan

Table 63: Types of bioreactors in Plant in Yangzhou

Table 64: Overview of R&D Center and Industry Scale Manufacturing Plant in Taiwan

Table 65: Overview of Pilot Scale Manufacturing Plant in Yangzhou

Table 66: Overview of bioprocessing equipment and technologies used for United Biopharma

Table 67: Overview of the equipment in the quality control laboratory of Taiwan plant

Table 68: Overview of facilities featured in India

Table 69: Facility Highlights of Aurobindo’s manufacturing plant

Table 70: Aurobindo’s pipeline information for their vaccines and biologics products

Table 71: Facility Highlights for CPL’s manufacturing plant in Gujarat

Table 72: Product Pipeline for CPL’s manufacturing facility

Table 73: Features of CPL’s Bulk Production and formulation facility

Table 74: Facility highlights of Enzene’s Manufacturing plants in Pune

Table 75: Facility highlights of Intas manufacturing facility

Table 76: Pipeline pf Plasma derived products

Table 77: Pipeline of Intas’s Biosimilars

Table 78: Progressive pipeline of products in the manufacturing facility

Table 79: Facility highlights of Kemwell’s manufacturing plant in Banglore

Table 80: Kemwell’s Product pipeline and their stage of development

Table 81: Type and batch sizes of bioreactor used in Kemwell’s facility

Table 82: Fill and Finish capabilities of Kemwell’s facility

Table 83: Flexibilty design checklist and features of Kemwell’s facility

Table 84: Equipment installed in Kemwell’s facility and their providers

Table 85: Facility highlights of Lupin’s manufacturing plant

Table 86: Lupin’s pipeline of products manufactured

Table 87: Equipment used in Lupin’s manufacturing facility

Table 88: Facility highlights of the Serum’s manufacturing plant in Pune

Table 89: Facility highlights on Stelis Biopharma’s Banglore facility

Table 90: Stelis Biopharma’s pipeline of Products and their stage of development

Table 91: Breakdown of Stelis Biopharma’s facility size into each space of the plant

Table 92: Process optimisation and capabilities for the two expression systems in Stelis Biopharma’s facility

Table 93: Drug substance manufacturing features and the respective expression systems in Stelis Biopharma’s facility

Table 94: Equipment used in Stelis Biopharma’s bioprocessing value chain and their provider

Table 95: Stelis Biopharma’s Fill and Finish Equipment and their features

Table 96: Facility highlights of Reliance Life Science’s manufacturing facility

Table 97: Reliance Life Science’s manufacturing plants and the products manufactured

Table 98: Overview of facilities featured in Korea

Table 99: Facility highlights of Osong Plant, South Korea: Aprogen

Table 100: Development of biosimilars in the pipeline of Aprogen

Table 101: Highlights of both Songdo and Osong manufacturing facilities: Binex, 2020

Table 102: Types of products manufactured for their clients

Table 103: Products currently in the R&D pipeline in Binex’s facility

Table 104: Number of Batches of Drug Substance and Drug Product Manufacturing completed in Binex’s facility

Table 105: Binex’s Songdo facility milestone timeline

Table 106: Binex’s Osong facility milestone timeline

Table 107: Various fill and finish systems employed and Binex’s capacities

Table 108: Process Technologies used in the various stages of development in Binex’s facility

Table 109: Facility Highlights of Celltrion’s three plants; Celltrion 2020

Table 110: Celltrion’s product pipeline and their stage of development

Table 111: Type and batch size of bioreactors used in Celltrion’s manufacturing facility

Table 112: Process technologies used in the bioprocessing value chain: Celltrion

Table 113 Features of Celltrion’s facility: Upstream to Packaging

Table 114: Facility Highlights on both plant 1 and plant 2; Eubiologics, 2020

Table 115: Product details of Euvichol and Euvichol-plus

Table 116: Type of bioreactor and batch sizes used in each of the expression systems in Eubiologic’s facility

Table 117: Equipment used in Eubiologic’s plant 1 and plant 2 in both the expression systems

Table 118: Bioprocessing equipment used across the Eubiologic’s value chain and their providers

Table 119: Facility Highlights of GC Lab cell

Table 120: Product Pipeline for Hwasun Facility

Table 121: Product pipeline for GC lab cell facility, as of May 2019

Table 122: Building layout of GC Pharma’s Hwasun Facility

Table 123: Facility highlights of Kolon Life Science’s B1 and B2 plants

Table 124: Facility Size of both plants in square ft: Kolon Lifesciences

Table 125: Equipment used in the bioprocessing value chain for B1 facility and their providers

Table 126: Equipment used in the bioprocessing value chain for B2 facility and their providers

Table 127: Facility highlights of Medipost’s manufacturing plant

Table 128: Checklist of their facility design and its flexibility

Table 129: Facility Highlights of Polus manufacturing plant, 2020

Table 130: Pipeline of products manufactured in Medipost’s facility: Polus

Table 131: Facility size in square metres: Polus

Table 132: Production capacity for drug substance and drug product manufacturing: Polus

Table 133: Facility highlights of Samsung Biologics three manufacturing plants: Samsung Biologics

Table 134: Bioreactor sizes and their respective stage of production for each of the manufacturing plants: Samsung Biologics

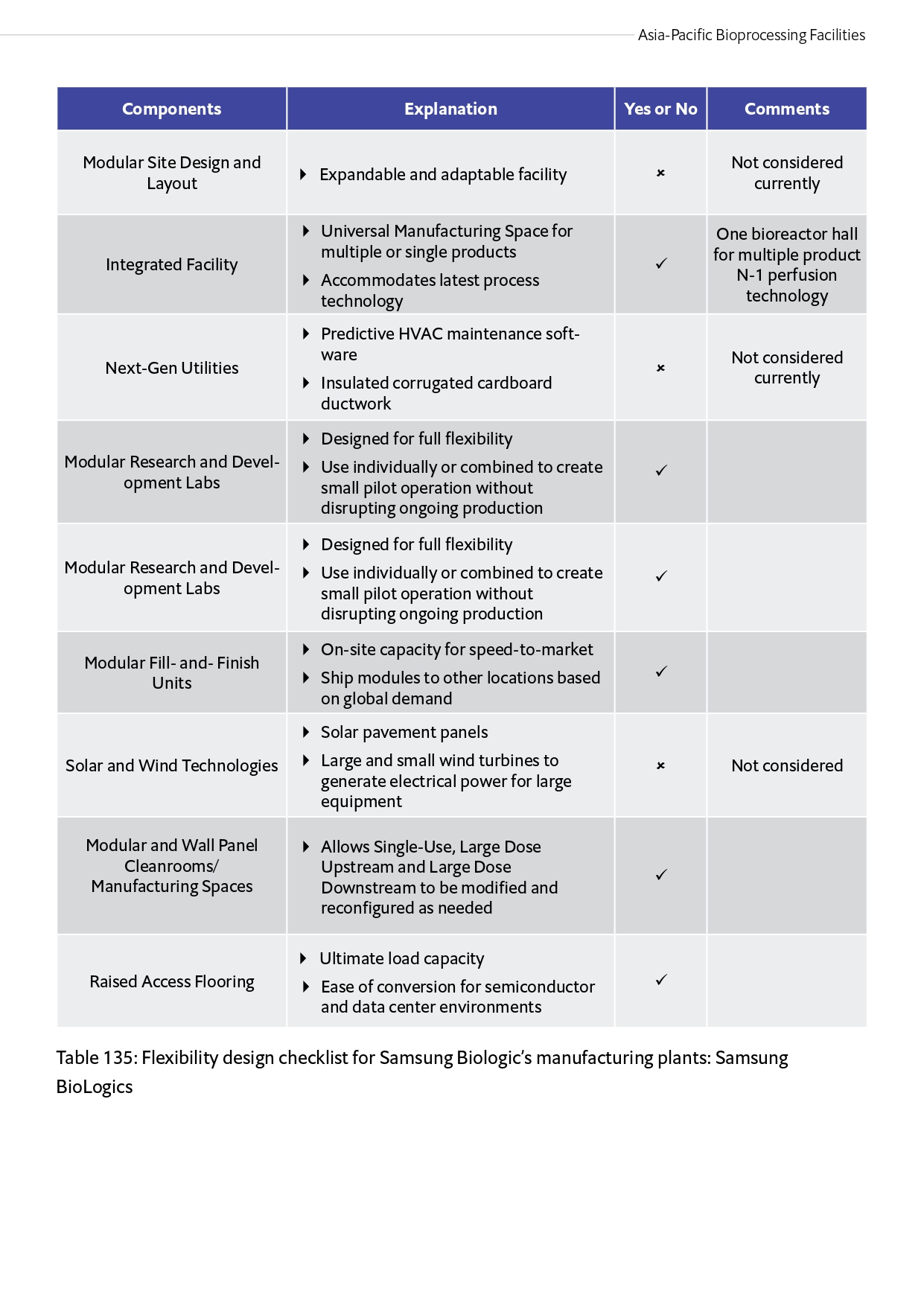

Table 135: Flexibility design checklist for Samsung Biologic’s manufacturing plants: Samsung Biologics

Table 136: Drug Product manufacturing for plant 1 and 2: Samsung Biologics

Table 137: Equipment used by their manufacturing plant and its provider: Samsung Biologics

Table 138: Overview of facilities featured in Japan

Table 139: Facility highlights of Astella’s cell therapy manufacturing plants

Table140: Facility Highlights of Ukima Plant1-3, Tokyo: Chugai Pharmaceuticals

Table 141: Facility Highlights of Utinosoma plant 1 and 2, Tokyo: Chugai Pharmaceuticals

Table 142: Chugai: Four products that have obtained Breakthrough Therapy Designation by the US FDA

Table 143: Pipeline of antibodies produced by Chugai and their stage of production

Table 144: Summary of the Chugai’s biologics manufacturing plants in Utsunomiya and Ukima, Japan

Table 145: Chugai: Comparison between Fed Batch process used in the rest of the plants and Perfusion Process used in UK3

Table 146: Hitachi: Facility Highlights of Yokohama facility in Japan: Hitachi Chemical Advanced Therapeutics

Table 147: Facility highlights of Sumitomo Dainippon’s plant

Table 148: Products under Sumitomo’s pipeline and their current development status, 2019

Table 149: iPS cell culture with automated cell culture equipment

Table 150: Overview on companies covered in SEA region

Table 151: Facility highlights for Abbvie’s manufacturing plant

Table 152: Equipment used in the bioprocessing value chain

Table 153: Next-Gen Biomanufacturing Facility, Amgen

Table 154: Facility Highlights of Amgen’s Tuas Plant, Singapore

Table 155: Features of Amgen’s flexible manufacturing plant

Table 156: GSK’s facility highlights in Tuas Biomedical Park

Table 157: Details of PT Kalbe’s Modular Facility Design

Table 158: Milestones Achieved by Siam Biosciences (2011-2020)

Table 159: CSL’s manufacturing facilities worldwide

Table 160: Facility highlights of Broadmeadows facility in Victoria, Australia

Table 161: Pipeline of products in CSL and their developmental stage

Table 162: The attributes and scope limits of downstream and upstream processing in the CSL’s biomanufacturing value chain

Table 163: Clayton manufacturing facility and the bioreactors used

List of Figures

Figure 1: Overall breakdown of the facilities in terms of their location, year of establishment and the features of the plant

Figure 2: Facility Establishment vs Year of Operation

Figure 3: Facility sizes of the manufacturing plants featured in the APAC region

Figure 4: Facilities with size ranging from 80,000sqm to over 200,000sqm

Figure 5: Percentage of bioreactor types employed

Figure 6: Regional distribution of bioreactor types used

Figure 7: SUS Use in China& Taiwan’s Bioprocessing Facilities

Figure 8: Stainless Steel System in Korea’s Bioprocessing Facilities

Figure 9: Percentage of expression systems employed

Figure 10: Percentages of the process technologies employed

Figure 11: Facility investment in APAC

Figure 12: Expression Systems in APAC Facilities

Figure 13: SUS Bioreactor: Process Development to Manufacturing

Figure 14: Batches Run by a Plant in 12 months (Commercial Production)

Figure 15: Batches Run by a Plant in 1 year (Pilot & Commercial)

Figure 16: Facility Cost-Saving Considerations & Need of the Hour

Figure 17: Key challenges faced by facility operators across Asia

Figure 18: Respondent Analysis: Expansion Plans

Figure 19: Process challenges faced by the industry

Figure 20: Technology need of the hour by ranking

Figure 21: Beigene’s KUBIO’s Biomanufacturing Facility, Guangzhou

Figure 23: Chime Biologics’s manufacturing facility in Wuhan BioLake Biotech Industry Development Zone

Figure 24: Bioprocessing equipment inside Chime Biologics’s manufacturing facility

Figure 25: Bioprocessing technologies inside Chime Biologics’s manufacturing facility

Figure 26: Bioprocessing equipment in Chime Biologics’s manufacturing facility

Figure 27: Bioprocessing technologies in Chime Biologics’s manufacturing facility

Figure 28: Main Line of Businesses: Eirgenix, Taiwan

Figure 29: Eirgenix’s commercial facility

Figure 30: Capacity of Eirgenix’s Hsnichu Biologics Plant

Figure 31: Milestones Achieved: Innovent Biologics

Figure 32: External look and interior design of Innovent Biologics manufacturing facility

Figure 33: Product pipeline of JHL Biotech (as of Jan 2020)

Figure 34: Process technologies of JHL manufacturing facility

Figure 35: Product pipelines of Shanghai Junshi Biosciences

Figure 36: The company structure of Medigen Biotech

Figure 37: Process Technologies Used by Mycenax

Figure 38: Bioprocessing technologies and equipment in Mycenax’s bioprocessing facility

Figure 39: Different technology platform in Mycenax’s bio-manufacturing facility

Figure 40: Regulatory approval timelines of Mycenax’s bio-processing facility

Figure 41: Facility scale-up and development of Pfizer

Figure 42: Number of resources working in different divisions in Taichung Plant

Figure 43: Milestones & Development timelines of Pharmaessentia from year 2003 to year 2019

Figure 44: Taichung PEG production area and filling plant

Figure 45: Process technologies in Pharmaessentia’s facility

Figure 46: Bioprocessing equipment in Pharmessentia’s Taichung plant

Figure 47: Regulatory approvals timelines of Pharmaessentia’s Taichung plant

Figure 48: Product pipeline of Shanghai Henlius Biotech

Figure 49: Changping Vaccine Production Center

Figure 50: Sinovac (Dalian) Vaccine Technology Co Ltd

Figure 51: Tangshan Yi’An Animal Vaccine Production Center

Figure 52: Beijing Headquarter

Figure 53: Product pipeline of TOT Biopharm

Figure 54: Flow chart for typical traditional process

Figure 55: Flow chart for PB Hybrid Technology

Figure 56: Facility scale-up and development timelines of United Biopharma

Figure 57: Exterior outlook of plant in Taiwan

Figure 58: Exterior outlook and bioprocessing equipment in plant in Yangzhou

Figure 59: Features of Upstream Processing, Downstream Processing and the expression platforms of the manufacturing facility

Figure 60: Process Technologies Employed in CPL’s facility

Figure 61: The red boxes above illustrate the disposable systems in CPL’s facility

Figure 62: cGMP Production Facility in MIDC, Chakan (Unit I) Pune, India

Figure 63: Manufacturing Plant in MIDC, Bhosati (Unit II), Pune India

Figure 64: Bioprocessing equipment in Mammalian Manufacturing Unit

Figure 65: Bioprocessing technologies in Mammalian Manufacturing Unit

Figure 66: Bioprocessing Technologies in E-Coli Manufacturing Unit

Figure 67: Stelis Biopharma’s facility expansion till FY 2020

Figure 68: Organisational experience in development, scale up and manufacturing in Stelis Biopharma

Figure 69: Overall Organisation Chart for Binex

Figure 70: Summary of their drug product manufacturing process flow

Figure 71: Process flow from cell line development to manufacturing

Figure 72: Product pipeline of Eubiologics, 2020

Figure 73: Overall layout of plant 1 in Chuncheon-si, Gangwon-do

Figure 74: Timeline of milestones achieved from 2016: Polus

Figure 75: Facility design from level 1 to 6

Figure 76: Astellas manufacturing plant in Toyoma Centre

Figure 77: Astellas manufacturing plant in Tsukuba

Figure 78: Chugai: Bioreactor columns and Purification lines in Chugai’s UK3 plant

Figure 79: Chugai: Box in Box reconfigurable Factory of UK3 plant

Figure 80: Chugai: Current Fed Batch Manufacturing Process employed in Uk1,2 and 3UT1,2

Figure 81: Chugai: Continuous Purification for UK3

Figure 82: Development of Chugai’s facility over the years

Figure 83: Yokohama Plant; Hitachi Chemical Advanced Therapeutics Solutions, 2020

Figure 84: Hitachi: Counter-Flow Centrifugation System

Figure 85: Hitachi Equipment found in the development room in Hitachi

Figure 86: Location of Sumitomo’s offices and plant in Japan

Figure 87: Cell Therapy Manufacturing plant in Osaka Prefecture, Sumitomo Dainippon

Figure 88: Closed system used by Sumitomo for cell therapy manufacturing

Figure 89: Automated cell- culturing equipment

Figure 90: Comparison between manual method and closed system

Figure 91: Sumitomo: The high-throughput cell sorter used in the manufacturing plant

Figure 92: Gigasort system, Cytonome/ST, LLC, Cell Sorter

Figure 93: Development process of ADCs

Figure 94: Amgen Facilities Operational Benefits generation facility Source: Biologics Manufacturing Asia (2019)

Figure 95: Comparison of Amgen Rhode Island Facility vs Amgen Singapore (Productivity vs Reduced Facility Size)

Figure 96: Closed processing system. Source: IMAPAC’s Biologics Manufacturing Asia Conference Singapore, 2018

Figure 97: Continuous perfusion culture in the next generation facility

Figure 98: Perfusion system and its impact on Volumetric productivity

Figure 99: Roller Bottle Technology used in PT Kalbio’s Manufacturing Plant; February 2019

Figure 100: Robotic Technology @ PT Kalbe’ Facility. Source: Biologics Manufacturing Asia 2019

Figure 101: Automated Chromatography Equipment: PT Kalbe, Source: Biologics Manufacturing Asia 2019 (February 2020)

Figure 102: Bioprocessing Equipment in Siam Biosciences, Thailand (April 2020)

Figure 103: R&D Manufacturing Suites of TCELS, April 2020

Figure 104: Design of the manufacturing suite: CSL Behring

Single – User Access

This license grants the right of use of the purchased report to a single recipient only. You may access the material on your computer, as and when required, for your own personal use.

Multi – User Access

Upto 3 users: This license grants the right of use of the purchased report by upto 3 users of the same firm/enterprise.

Corporate Access

Unlimited user access (Within your organization): This license entitles the buyer of the report to share, distribute the report (either full or in part) with other employees of the same firm/enterprise. The report may be accessed by any employee of the enterprise and there is no limit on the number of users.

Additional information

| User Access | Corporate Access, Multi – User Access, Single – User Access |

|---|

Reviews

There are no reviews yet.